Global Migration of Talent and Tax Incentives. Malaysia has a wide variety of incentives covering the major industry sectors.

到底几时要报税 2017年income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

On 30 August 2017 two orders PUA 2522017 and PU A 2532017 that are effective as from year of assessment 2015 were published in Malaysias federal gazette to.

. Nevertheless a company eligible for a. Although Malaysia is neither a tax haven nor a low tax jurisdiction for companies which are eligible for the tax incentives the effective tax rates may be significantly below the normal. Plan to submit an application for MSC Malaysia Tax.

5 BOG have been reviewed and amended to adhere to. Printed in Malaysia by SP-Muda Printing Services Sdn Bhd 906732-M 82 83 Jalan KIP 9 Taman Perindustrian KIP Kepong 52200 Kuala Lumpur Tel. Malaysia is also committed to align themselves to the global standards.

2018 Personal Tax Incentives Relief for Expatriate in Malaysia. This is demonstrated through. For expatriates working for Labuan International there is a special rebate where foreign directors income is zero tax and.

Incentive approved after 16 October 2017 - grandfathering period is up to the date of gazette or 31 December 2018 whichever earlier. Manufacturers of pharmaceutical products including vaccines investing in Malaysia Applications received by 31122022 Income tax rate of 0 up to 10 for first 10 years and at. Malaysia Budget 2017 Incentive for Parents.

A7 Entitled to claim incentive under section 127 2 Approved donations gifts contributions 7 - Gift of money to an approved fund. Resident individuals are eligible to claim the following tax rebates which are to be deducted from tax charged. Companies which had been successful in increasing revenues will benefit from reduction in their income taxes for the year of assessment 2017 and 2018.

The 2017 Budget also aims to intensify its income tax and GST collections with a new Collection Intelligence Arrangement which combines the efforts of the Inland Revenue Board the Royal. Updated on Thursday 17th August 2017. As highlighted in earlier tax alerts the financial incentives under the Multimedia Super Corridor MSC Malaysia Bill of Guarantee No.

The Malaysian Investment Development Authority MIDA has issued revised guidelines for the principal hub incentive introduced in April 2015 which are. Last reviewed - 14 December 2021. Blog Bahasa Melayu.

Sources outside Malaysia - 1 - c PU. Incentives for companies in Malaysia. If a new qualifying activity is approved after Oct 162017 the.

In Malaysia the corporate tax rate is now capped at 25. The tax incentive given under ITA is in the form of allowance in addition to the capital allowance on qualifying plant and equipment acquired by the company during the ITA. 2017 Malaysia Budget Speech Tax Highlights Crowe Horwath Kuala Lumpur.

Investments in a number of industries in Malaysia are facilitated by the available tax incentives. 6 years ago Wilson Ng. 2017 the income tax imposed for the first RM 10 million will be 24 ie the chargeable tax will be RM 24.

Tax Incentives for Economic Development Regions 3. This rule shall not apply to. As it is Malaysias tax incentives are generally tied to substantial substance requirements in Malaysia.

14 August 2017. Our lawyers in Malaysia describe the tax incentives programme in the country. Individual - Other tax credits and incentives.

Check out the Budget 2017 tax incentives initiatives aim to spur the growth of Malaysian Internet Business presented in this blog with our infographic. Malaysia Budget 2017 Incentive for Parents 2 min read. Evidence from Malaysias Returning Expert Program.

There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Issued by the Safety and Security department of Cape Town. Corporate - Tax credits and incentives.

1 in Malaysia since 2005 we now serve over 75000 Customers. Any excess is not. Income tax incentives are granted to hotel operators who undertake investments.

Many tax incentives simply remove part or of the burden of the tax from business transactions.

Does Denmark Need Yet Another Tax Reform Ecoscope

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16283719/ff_subsidies.png)

Fossil Fuel Subsidies The Imf Says We Pay 5 2 Trillion A Year Vox

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

The Right Kind Of Help Tax Incentives For Staying Small In Imf Working Papers Volume 2017 Issue 139 2017

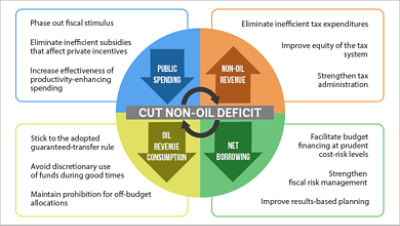

Kazakhstan Toward Fiscal Sustainability And Economic Transformation

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

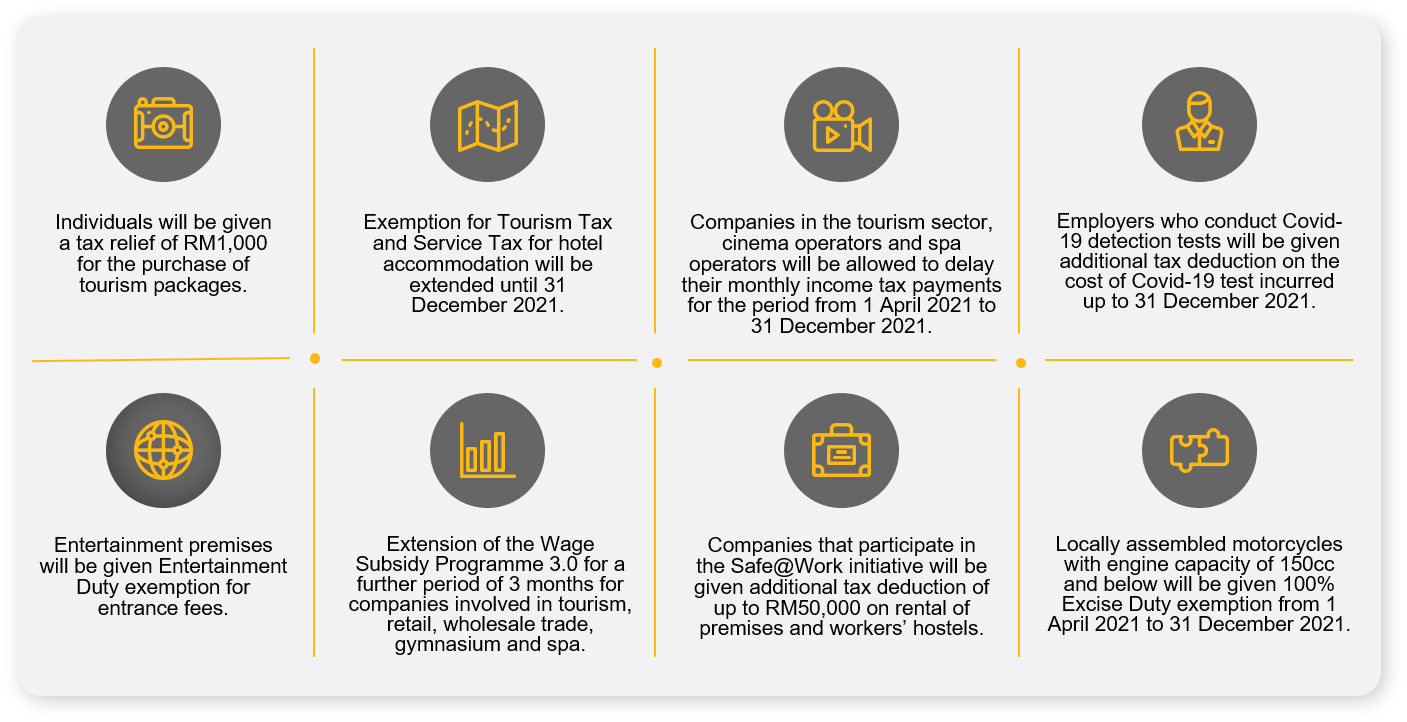

Pemerkasa Assistance Package Crowe Malaysia Plt

The Right Kind Of Help Tax Incentives For Staying Small In Imf Working Papers Volume 2017 Issue 139 2017

Malaysia Payroll And Tax Activpayroll

Individual Income Tax In Malaysia For Expatriates

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Malaysia Income Tax Guide 2016 Ringgitplus Com

The Right Kind Of Help Tax Incentives For Staying Small In Imf Working Papers Volume 2017 Issue 139 2017

Malaysia Tax Incentives Included In Economic Package Kpmg United States

The Right Kind Of Help Tax Incentives For Staying Small In Imf Working Papers Volume 2017 Issue 139 2017

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

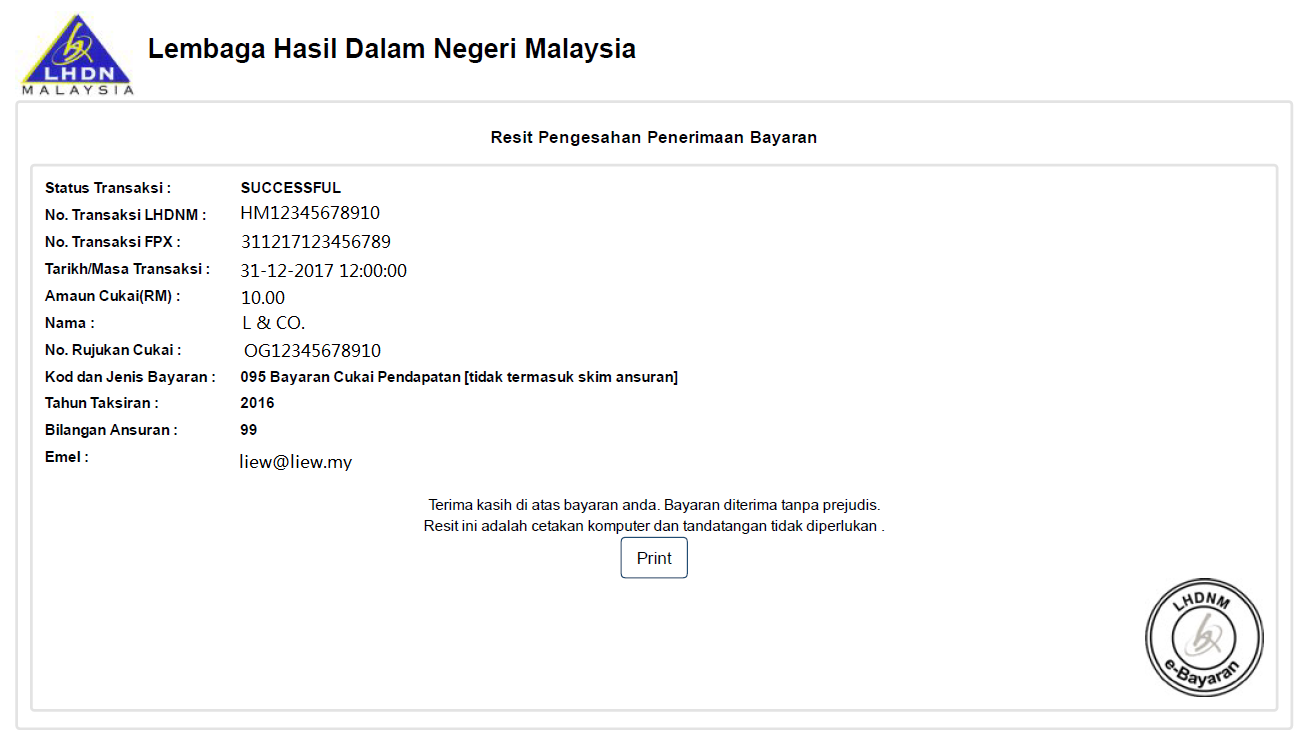

Tips For Income Tax Saving L Co Chartered Accountants

2017 Personal Tax Incentives Relief For Expatriate In Malaysia